1. Should I file bankruptcy?

The decision to file bankruptcy is a personal one. There are clear instances when I would recommend filing. The first strong indicator to file is when a creditor files a wage garnishment. There are three ways to avoid or stop a garnishment: 1) pay it; 2) quit your job; or 3) file bankruptcy. A wage garnishment does not require the filing of a bankruptcy, but it is a strong indicator that a bankruptcy may be necessary. If a garnishment has been filed, you should consider the amount of the garnishment and what resources (income and property) are available to satisfy it. A second indicator that bankruptcy is viable is where there has been a foreclosure or repossession of property. Generally, these events result in large amounts of debt and can be extremely harmful to the person’s credit. A final indicator is when the amount of debt is simply overwhelming in comparison to the resources available. Every situation is unique, so it is important to meet with an experienced attorney to discuss your income, assets and debt. Most bankruptcy attorneys will provide a free initial consultation, so you have nothing to lose. You should feel no obligation to file when you meet with the attorney, and you should leave the appointment armed with information.

Alternatively, there is one particular instance that a person need not file bankruptcy, no matter how substantial the debt. That instance is where the debtor is “judgment proof.” This means that the debtor has no assets that the creditor can reach, available to satisfy the judgment. A creditor can only garnish wages, place a lien against a house (with a judgment) or seize a bank account. Judgment proof debtors don't have these assets. A person who receives Social Security, disability, or retirement income and owns no real estate could be an example of a person who is "judgment proof." Social Security, disability income, and retirement income are exempt from creditors. So is the money once it hits your bank account. If there is no real estate, there is nothing that creditors can take. If a “judgment proof” debtor can withstand annoying phone calls, they need not file for bankruptcy. There are no debtor’s prisons, and like they say, you can't get blood from a turnip! Nothing bad can happen to a person who is judgment proof. Such a person would only file a bankruptcy for peace of mind.

Some people feel that filing bankruptcy is morally wrong or will otherwise cause them to be stigmatized. Interestingly, bankruptcy has its roots in ancient Jewish culture. In Deuteronomy 15:1-2, God instructs the Israelites through Moses, “At the end of every seven years you must cancel debts. This is how it is to be done: Every creditor shall cancel any loan they have made to a fellow Israelite. They shall not require payment from anyone among their own people, because the LORD's time for canceling debts has been proclaimed…” (NIV). The United States Bankruptcy Code used to allow the filing of bankruptcy to cancel debts every seven years, just like Deuteronomy 15 commands. That law was only recently changed in 2005, requiring eight years between Chapter 7 Bankruptcies. If you are concerned about the moral implications of bankruptcy, I can assure you that creditors know full well of the bankruptcy laws, and the risk that a debtor might file bankruptcy is part of the cost of doing business. If you are concerned with stigma, bankruptcy filings are not published in the local newspaper. They are public records, but generally require the public to have special login information with the clerk of courts to look the cases up.

2. Do I qualify?

To determine whether a person qualifies for bankruptcy, the bankruptcy court evaluates the filing party’s household income, applying something called the "means test." A good starting point is to determine whether your grouse household income (total income, before taxes are paid) is less than the Ohio Median Household Income standards. Ohio’s median income standard for Richland County, Ohio is as follows:

- 1-person household: $61,617

- 2-person household: $77,816

- 3-person household: $94,913

- 4-person household: $113,435

This is a starting point for considering whether you can file. If your income is greater than the Ohio Median Household Income standards, you can still qualify, but your means test becomes a more complex calculation. A trained, experienced attorney will need to evaluate whether certain household expenditures, such as your mortgage payment, utilities expenses, vehicle payments, medical costs, and other considerations will nonetheless help you qualify. Income such as Social Security, Unemployment Compensation, Pension/Retirement is treated differently, and the attorney can assist you with evaluating this income, as well.

Oftentimes, people think that the nature of their debt or assets will prevent them from qualifying for bankruptcy. Your debt and assets might be the primary reason you want to file, but the question was about whether you qualify to file. An experienced attorney would caution you against filing a bankruptcy immediately after incurring debt or, selling or giving away property, or paying off accounts. There can be a look-back of anywhere from ninety (90) days to one (1) year. The attorney will be aware of specific timing requirements for these sorts of transactions. Also, the structure of a person’s assets may impact whether it is desirable for the person to file, depending on his or her goals (see the next question below).

3. Will I lose all of my stuff?

In most instances, the United States Trustee’s office determines that a Chapter 7 Bankruptcy is a “no asset” bankruptcy. That is good for the debtor. That means that there are “no assets” in the bankruptcy estate available to be liquidated to pay off creditors. But what if I have a house? Or a car? Or some cool fishing gear? The bankruptcy code and Ohio law separately provide bankruptcy “exemptions,” meaning equity in assets that is “off limits” to creditors. Ohio’s exemptions are located in Ohio Revised Code (R.C.) 2329.66. As of the date of this article, real estate used for the debtor’s residence is exempt up to $161,375 in equity, per debtor. Each debtor gets an exemption of up to $4,450 of equity in one motor vehicle, an exemption of up to $14,875 in his or her household goods. There is a “wildcard” exemption that can be applied to any asset of the debtor, up to $1,475. As you can see, assets are generally protected in a bankruptcy.

Note that these exemptions are in equity. So, if you own a $15,000 vehicle that you just drove off the lot, odds are good that you have little to no equity in the vehicle. Equity is the difference of the value of property, less the money or debt owed on that property. Most people will find that, when filing a bankruptcy, their property might be valuable to them, but it has little value on the open market.

Another consideration is the idea that you can actually use a bankruptcy to get out of a debt on property that you no longer want. Perhaps you have a vehicle that is simply too expensive and you would like to turn it in without owing any money on it. Perhaps your house is in foreclosure and you simply want to walk away. A Chapter 7 Bankruptcy is a guaranteed way to do these things with the backing of the federal government.

4. How long does it last?

One of the largest time requirements to preparing a bankruptcy is actually obtaining the complete and accurate information necessary to file. This will wholly depend on your organization. Once the information has been collected, the actual bankruptcy process lasts approximately four months. One to two months after you file, there will be a “341 Meeting of the Creditors.” Your attorney will prepare you for this meeting and assuming your attorney did his job, it is nothing of which you should be concerned. Approximately sixty days after the meeting, your debts will be discharged.

5. How long do I have to wait to file again?

A person who has previously filed for bankruptcy has to wait at least eight years to file again. The time starts running from the date of filing. If you filed previously, but don’t remember when, an attorney can look up the information for you. You will need to know the name you went by and where you lived at the time of filing.

6. How much does it cost?

The filing fee charged by the court is currently $338. It has historically been increased from time to time. The attorney’s fee varies, depending on the attorney’s office and the services that the attorney’s office provides. As of the date of this article, Attorney Boyd Law Office, Ltd. charges a $1,800 all-inclusive fee for a Chapter 7 Bankruptcy filing, which includes all services customarily provided in a Chapter 7 Bankruptcy, as well as the filing fee, and the cost of a credit report. There are no hidden fees, ala carte charges or additional fees for what should have been included in the first place. This fee is subject to change from time to time.

Should I Pay the Waiver?

Should I Pay the Waiver? Felony THC Possession

Felony THC Possession Forming an LLC

Forming an LLC Anatomy of a DUI Case

Anatomy of a DUI Case A Criminal Case: From Arraignment to Trial

A Criminal Case: From Arraignment to Trial Winning a Social Security Disability Case

Winning a Social Security Disability Case 8 Reasons to Have a Will

8 Reasons to Have a Will 9 Divorce and Custody Questions

9 Divorce and Custody Questions Issues Considered in a Domestic Relations Action

Issues Considered in a Domestic Relations Action A Step by Step Guide to Search and Seizure

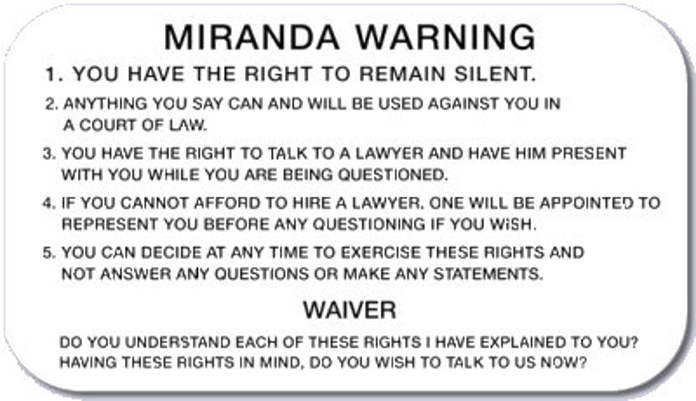

A Step by Step Guide to Search and Seizure You Have the Right to Remain Silent: Exercise It!

You Have the Right to Remain Silent: Exercise It! A Guide to DUI

A Guide to DUI Ohio Law Bans Red Light Cameras, Cities Sue

Ohio Law Bans Red Light Cameras, Cities Sue Sex Offender Fails to Disclose E-Mail: Prison

Sex Offender Fails to Disclose E-Mail: Prison Plea Deal Rules that Limit Advocates' Judgment

Plea Deal Rules that Limit Advocates' Judgment Private Universities’ Police Records are Public

Private Universities’ Police Records are Public NFL Players Prevail over Cleveland's Tax Practices

NFL Players Prevail over Cleveland's Tax Practices