1. What is Social Security Disability?

The Social Security Administration has two forms of benefits when a person becomes disabled: Social Security Disability Insurance (SSDI) benefits, also called Title II benefits, as well as Supplemental Security Income (SSI), also called Title XVI benefits. SSDI is available for disabled persons who had Social Security tax withheld from their paycheck in a sufficient amount over a sufficient period of time, while SSI is available for disabled persons who have limited income and resources (under $2000 for a person or $3000 for a couple).

2. What does Social Security Pay?

SSI typically pays less than SSDI. For 2016, SSI pays $733 per month while SSDI typically will pay more. SSDI is determined by the amount that you earned prior to becoming disabled; in 2015, the average SSDI monthly payment was $1,165, while the maximum payment an individual can receive is $2,663 per month.

3. Another agency found me to be disabled. Do I have to apply?

The Social Security Administration determines who is disabled according to their rules. For example, if you receive worker’s compensation for a workplace injury, or private disability insurance through an employer, you still must apply for and be determined to be disabled according to Social Security’s rules.

4. How long does it take to win?

Every claim is different. However, winning your disability claim often requires going through an administrative appeals process, which can take two years or more. If you are disabled and are working through the appeals process, do not lose hope. If your initial disability application is not approved, it is best to retain an attorney.

5. How does Social Security determine if I am disabled?

Social Security applies a five-step process to determine disability, but the most common reason for being denied, which I see all the time, occurs at Step 5. It says something like: “Your condition results in some limitations in your ability to perform work related activities. We have determined that your condition is not severe enough to keep you from working. We realize that your condition prevents you from doing some types of work but it does not prevent you from doing other work which is less demanding.”

This five step, sequential process asks the following questions in evaluating your claim:

- Are you engaged in substantial gainful activity (SGA)? You cannot work and be eligible for disability. If you make over $1,130 per month, you are too active to be disabled, according to Social Security rules.

- Do you have severe impairments? A severe impairment is anything that is medically determinable, it limits your ability to perform basic work activities, and is expected to last at least 12 months.

- Is your severe impairment at the level of severity listed in the Social Security Listing of Impairments? If so, you automatically are determined to be disabled.

- Do you have the residual functional capacity (RFC) to perform your past relevant work?

- Do you have the RFC to perform other work that exists in the national economy, meaning that the work exists in significant numbers in the region in which you live, or several other regions of the economy? Social Security will also use a grid of medical-vocational rules to consider your age, education, and skills developed from your past work experience when evaluating your RFC. Under certain circumstances, Social Security will determine that based on these factors, you should not be expected to work. If you qualify for disability in this manner, it’s called “gridding out.”

6. How do I pay an attorney?

When you do finally win your social security disability appeal, you will be entitled to back pay. You should only hire an attorney who charges a contingent fee – you only pay a fee if the attorney wins your case. Attorneys will generally charge 25% of your back pay, which is capped by law at $6,000.

If you have been denied Social Security Disability Insurance or Supplemental Security Income, you should get legal representation because the rules for determining disability are complex, and how your medical documentation is applied to the rules is specific and technical. An attorney should not charge a legal fee unless you win your case, so you have little to lose by being represented.

Should I Pay the Waiver?

Should I Pay the Waiver? Felony THC Possession

Felony THC Possession Forming an LLC

Forming an LLC Anatomy of a DUI Case

Anatomy of a DUI Case A Criminal Case: From Arraignment to Trial

A Criminal Case: From Arraignment to Trial 6 Questions About Chapter 7 Bankruptcy

6 Questions About Chapter 7 Bankruptcy 8 Reasons to Have a Will

8 Reasons to Have a Will 9 Divorce and Custody Questions

9 Divorce and Custody Questions Issues Considered in a Domestic Relations Action

Issues Considered in a Domestic Relations Action A Step by Step Guide to Search and Seizure

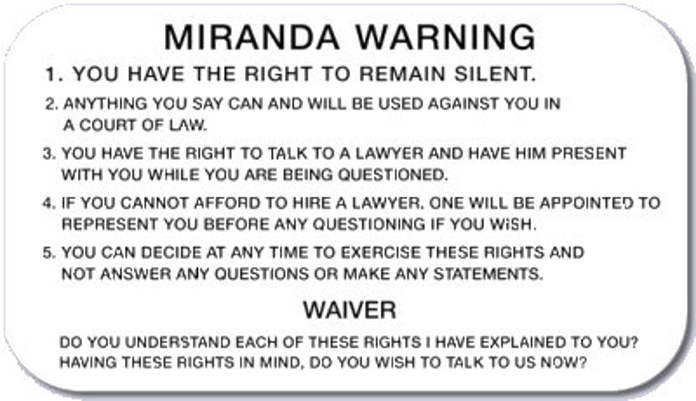

A Step by Step Guide to Search and Seizure You Have the Right to Remain Silent: Exercise It!

You Have the Right to Remain Silent: Exercise It! A Guide to DUI

A Guide to DUI Ohio Law Bans Red Light Cameras, Cities Sue

Ohio Law Bans Red Light Cameras, Cities Sue Sex Offender Fails to Disclose E-Mail: Prison

Sex Offender Fails to Disclose E-Mail: Prison Plea Deal Rules that Limit Advocates' Judgment

Plea Deal Rules that Limit Advocates' Judgment Private Universities’ Police Records are Public

Private Universities’ Police Records are Public NFL Players Prevail over Cleveland's Tax Practices

NFL Players Prevail over Cleveland's Tax Practices